We’ve broken down the steps for preparing an income statement, as well as some helpful tips. Consider enrolling in Financial Accounting or our other online finance and accounting courses, which can teach you the key financial topics you need to understand business performance and potential. Download our free course flowchart to determine which best aligns with your goals.

What are the differences between traditional and contribution margin income statements?

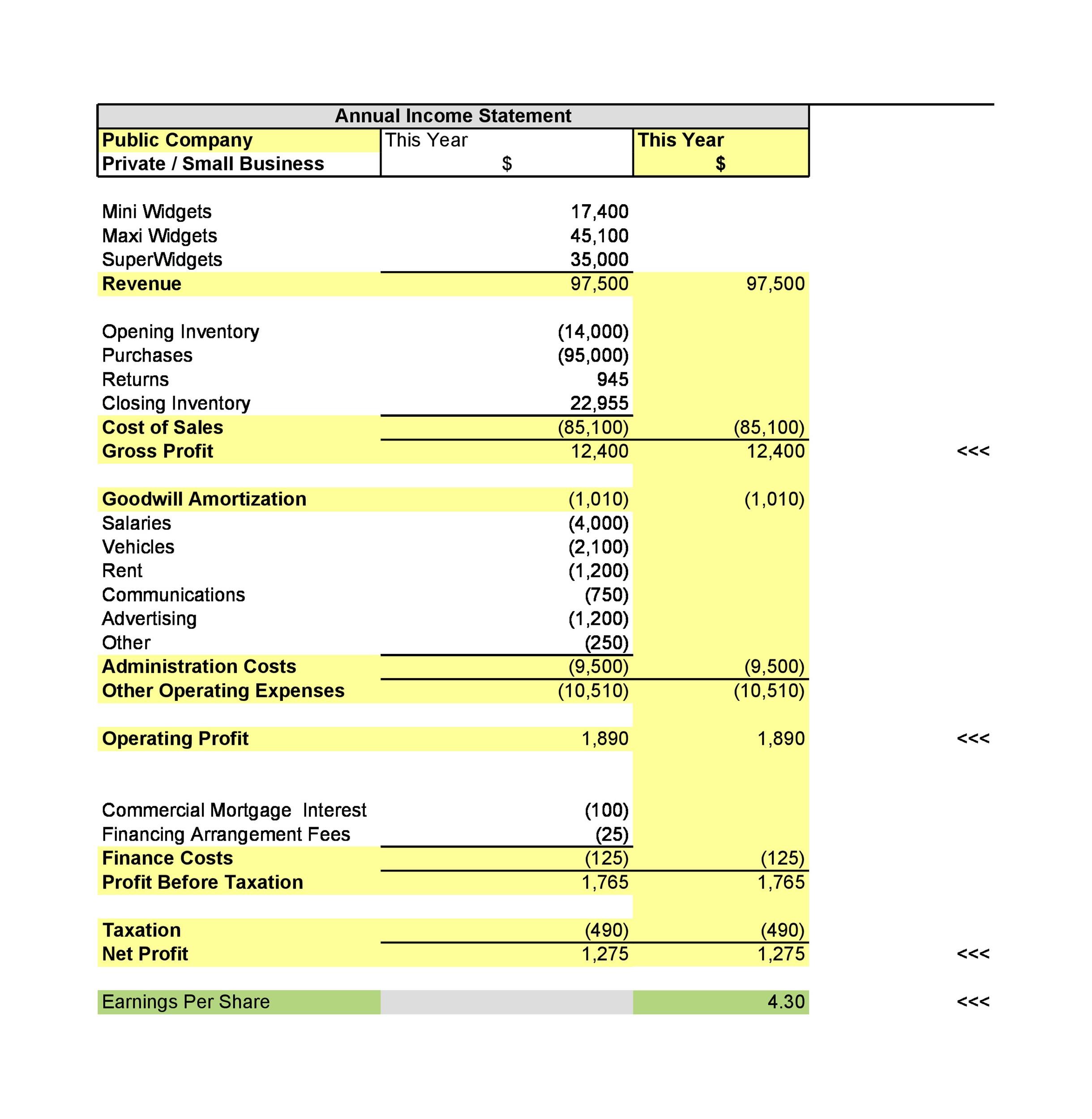

It shows you how much money flowed into and out of your business over a certain period of time. If your business owes someone money, it probably has to make monthly interest payments. Your interest expenses are the total interest payments your business made to its creditors for the period covered by the income statement. These expenses are listed individually here, but some income statements will bundle these and other similar expenses together into one broad category called “Selling, General & Administrative Expenses” (SG&A). When a business owner makes an income statement for internal use only, they’ll sometimes refer to it as a “profit and loss statement” (or P&L).

Identify cash flow issues

Expressed in monetary units, gross margin represents the difference between the selling price and the cost of your products or services. The gross margin shows whether a particular activity is likely to generate income or not. When used in conjunction with the other financial statements, an income statement can give you a clear view of your cash flow. Revenue is mainly from a company’s core operations—routine sales of products or services.

- A P&L, which stands for profit and loss, indicates how the revenues are transformed into net profit.

- External users like investors and creditors, on the other hand, are people outside of the company who have no source of financial information about the company except published reports.

- All programs require the completion of a brief online enrollment form before payment.

See profit at a glance

A negative income figure appears on a company’s income statement. A negative net income means a company has a loss over that given account period, not a profit. While your business may have positive how to use xero settings sales, you’ll end up with a negative net income if expenses and other costs exceed that amount. To finalize your statement, add a header to the report identifying it as an income statement.

Write your cost formula and plug in the number of units sold for the activity. Finally, the bottom line—the result of subtracting all expenses, interest, and taxes from a company’s revenues. If you prepare the income statement for your entire organization, this should include revenue from all lines of business. If you prepare the income statement for a particular business line or segment, you should limit revenue to products or services that fall under that umbrella. Your reporting period is the specific timeframe the income statement covers. You don’t need fancy accounting software or an accounting degree to create an income statement.

Cost Accounting Definition

The applications vary slightly, but all ask for some personal background information. If you are new to HBS Online, you will be required to set up an account before starting an application for the program of your choice. Correctly recording prepaid expenses and depreciation is crucial.

If you need help preparing or improving your income statements, schedule a call with one of our extremely experienced (40+ years!) small business accounting pros today. Small businesses typically start producing income statements when a bank or investor wants to review the financial performance of their business to see how profitable they are. Following operating expenses are other forms of income, known as income from continuing operations. This includes operating income, other net income, interest-linked expenses, and applicable taxes.

By following these steps, anyone interested, from a stakeholder to an external viewer, can get a clear picture of the company’s financial performance through the income statement document. FreshBooks accounting software provides an easy-to-follow accounting formula to make sure that you’re calculating the right amounts and creating an accurate income statement. Learning how to read and understand an income statement can enable you to make more informed decisions about a company, whether it’s your own, your employer, or a potential investment.

Next, $560.4 million in selling and operating expenses and $293.7 million in general administrative expenses were subtracted. This left the company with an operating income of $765.2 million. To this, additional gains were added and losses subtracted, including $257.6 million in income tax.

There are several ways multi-step income statements can benefit your small business. The elements of an income statement include revenues, gains, gross profit, expenses, losses, and net income or loss. The basic format is to simply show the sales less the cost of goods sold equal gross profit. And also show the gross profit less the selling and administrative expenses and that equals the operating income.